Verifiable Credentials Services

GoSource is a global leader in digital trust.

We are an active contributor to W3C and UN standards on digital identity and verifiable credentials, particularly in the business-to-business and trade domain. We have deployed verifiable credential solutions for both government and commercial customers.

GoSource digital trust services leverage our deep expertise in verifiable credentials and decentralised identifiers (DIDs). This helps our customers with both the business strategy and technology implementation services that will empower them to benefit from their participation in the digital “web of trust”.

What is a verifiable credential?

A verifiable credential (VC) is the digital and verifiable equivalent of everyday documents like licenses, permits, certificates, statements, and invoices. An issuer (e.g. an insurance company) issues a VC (e.g. an insurance certificate) to a subject (e.g. business that has purchased insurance) as a self-contained digital credential that is held by the subject. The VC can be presented to any verifier (e.g. a new customer that requires insurance evidence) and can be digitally verified without any need to contact the issuer. VCs are readable and verifiable by both humans and machines and so are compatible with existing paper or PDF documents in use today. Another nice feature of VCs is that they can be selectively redacted to hide information not required by the verifier. For example, a citizen might present only their age from a digital driver's license when buying alcohol.

What is a decentralised identifier?

Decentralised identifiers (DIDs), sometimes called Self-Sovereign Identifiers, are a new type of identifier that enable verifiable, decentralised digital identity.

A DID refers to any subject - a person, an organisation or even a thing such as a product or shipment. DIDs enable verifiers to confirm that the issuers and subjects of VCs really are who they say they are.

Some examples showing the power of digital trust:

- A government authority issues a driver's license VC to a citizen who can use it to prove their identity to a teleco to get a SIM or to prove their age to a liquor store.

- A bank issues an account statement VC to a customer who can use it to prove their financial balance when applying for a lease or to show regular payments when applying for a loan.

- A certifying authority issues an organic certificate VC for a consignment of cotton that is passed through the supply chain to the importer to verify the quality of their supply.

- An exporter issues an invoice VC to an importer who provides it to a trade finance institution to automate a letter of credit application.

- An insurance company issues professional indemnity and third-party liability insurance to a client who presents them to their own customers as evidence of compliance.

Using digital trust to improve your business processes and outcomes

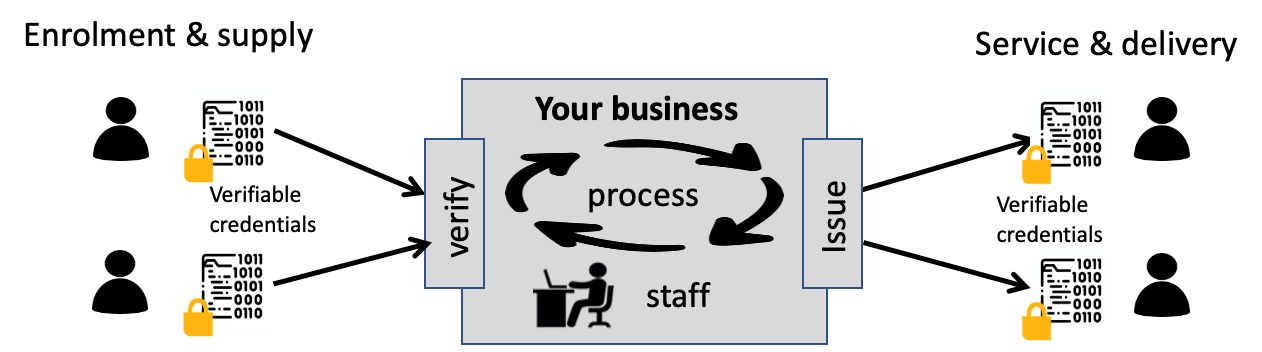

Almost every business or government agency has core business processes that take inputs and then performs some process to generate outputs that provide value to customers.

For example, an insurance company takes a customer's identity information together with financial and/or historical performance information. They use this to make a risk assessment to determine an appropriate premium for the customer. The insurer then issues an insurance certificate to their customer based on all this data.

- When inputs are digital and verifiable then your business processes have higher integrity, become more efficient and have lower risk.

- When you provide customers with outputs that are digital and verifiable, you empower them to use those credentials for their own verification requirements.

Speak to us about your digital trust requirements

GoSource digital trust services provide vendor neutral advice and implementation services.

We will start by modelling the “trust architecture” in which your business operates. This activity will identify the stakeholder types and digital credential types that represent the inputs and outputs of your business. It will also identity the “trust anchors” (such as regulators, certifying authorities, etc) that can add integrity to the verifiable credentials that you will issue or verify.

We will then design and implement a proof-of-concept that turns the theoretical model into a real implementation that will confirm the value of digital trust to your business.